Designing an energy arbitrage strategy with linear programming

The article discusses how to make money through energy arbitrage, which involves buying and selling energy for profit.

Get more great content for getting started with quant finance.

Energy arbitrage is a way to make money by taking advantage of differences in energy prices. It involves buying energy at a low price and then selling it at a higher price. This can be done with electricity, natural gas, or other forms of energy. By taking advantage of these price differences, energy arbitrage can be very profitable.

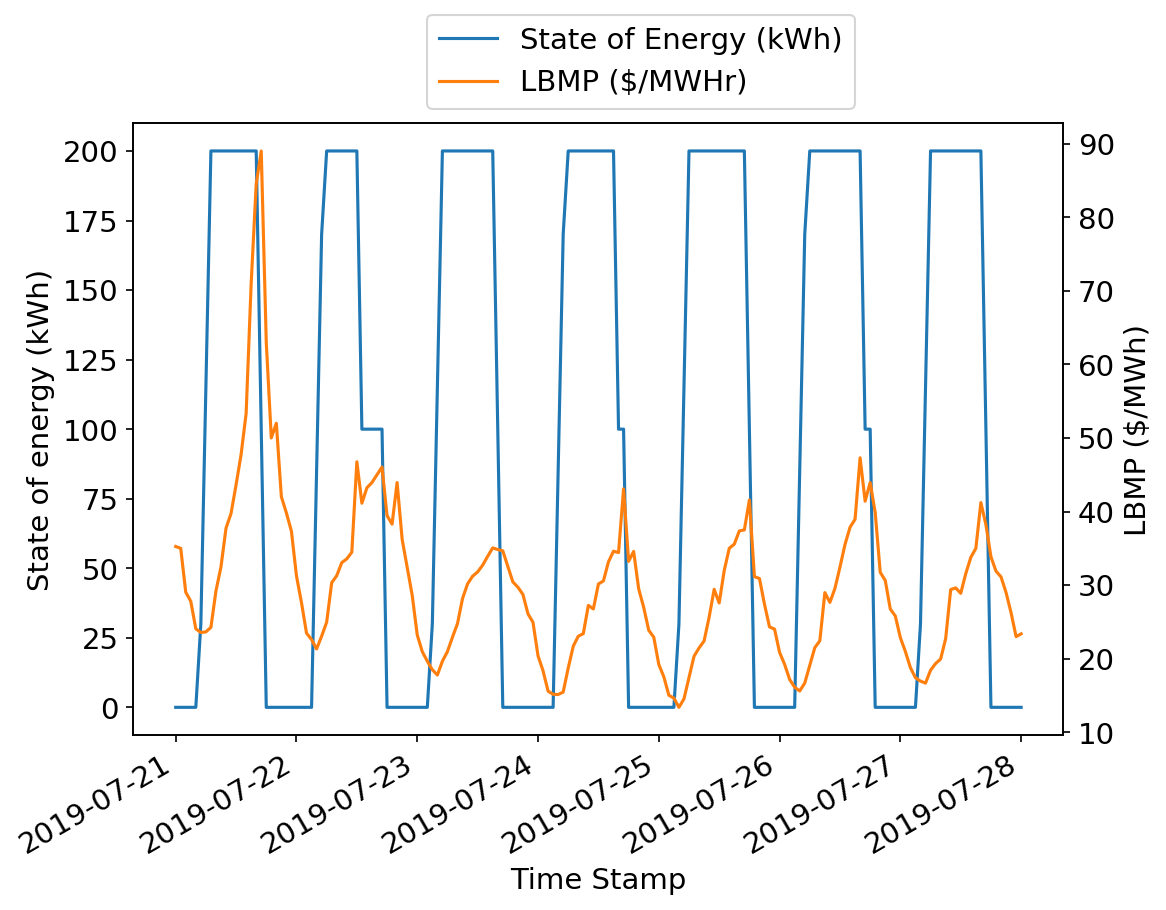

One way to do energy arbitrage is to buy energy when it is cheap and then store it until it becomes more expensive. This is called storage arbitrage. It can be done with batteries or other types of storage. Another way to do energy arbitrage is to buy energy from one market and sell it in another. This is called market arbitrage.

Energy arbitrage is becoming increasingly popular as energy prices continue to fluctuate. It is a great way to make money, but it requires a lot of knowledge and experience. It is important to understand the energy markets, the different types of energy, and the different ways to do energy arbitrage.

Energy arbitrage is a great way to make money. It involves taking advantage of price differences between different types of energy. There are two main ways to do energy arbitrage: storage arbitrage and market arbitrage. It is important to understand the energy markets and the different types of energy before attempting energy arbitrage.

Check out the full post at steveklosterman.com.