Fast Implied Volatilities using Chebyshev Interpolation

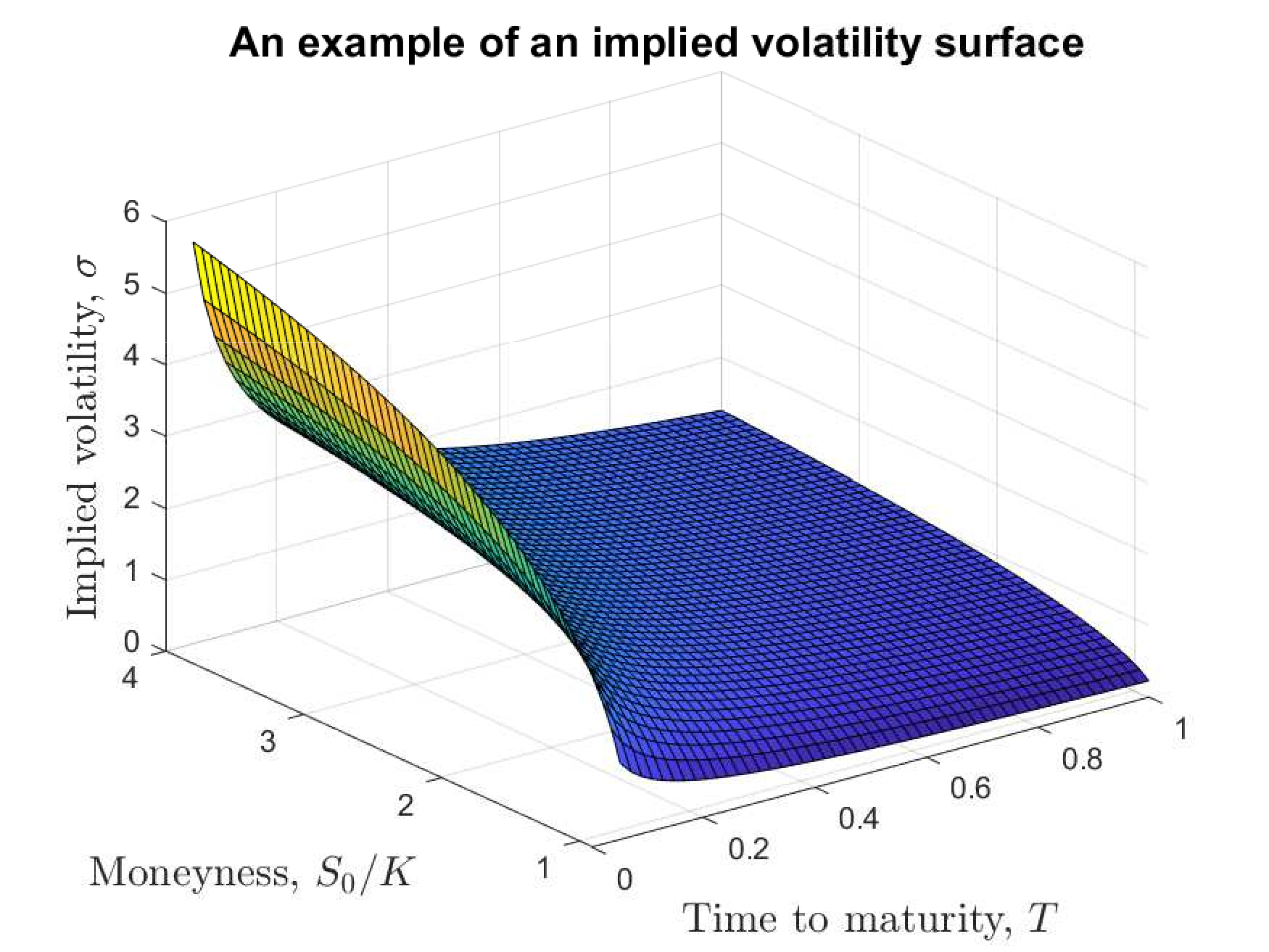

This article presents a method of quickly calculating implied volatilities using Chebyshev interpolation.

Get more great content for options trading with python.

This article discusses how Chebyshev Interpolation can be used to quickly calculate implied volatilities. Chebyshev Interpolation is a method of calculating a function from a set of discrete data points. It is used to create a smooth curve that can be used to estimate the value of a function at any point. The article explains how Chebyshev Interpolation can be used to calculate implied volatilities, which are used to measure the risk associated with a security. The article also explains how Chebyshev Interpolation can be used to more accurately predict the future volatility of a security.

The article explains that Chebyshev Interpolation is more accurate than other methods of calculating implied volatilities. This is because it takes into account more data points and is able to create a more accurate curve. The article also explains how Chebyshev Interpolation can be used to calculate implied volatilities for a variety of different securities, such as stocks, futures, and options.

The article also discusses the benefits of using Chebyshev Interpolation to calculate implied volatilities. It is faster and more accurate than other methods, and it can be used to quickly calculate the implied volatilities for a variety of different securities. Additionally, it can be used to more accurately predict the future volatility of a security.

Overall, this article explains how Chebyshev Interpolation can be used to quickly calculate implied volatilities. It is more accurate than other methods and can be used to calculate the implied volatilities for a variety of different securities. Additionally, it can be used to more accurately predict the future volatility of a security.

Check out the full post at nag.com.