Analyzing Stock Data Near Events with Pandas

This article explains how to use the Pandas library to analyze stock market data and events.

Get more great content for getting started with quant finance.

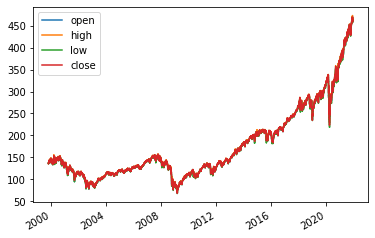

Pandas is a Python library that helps with data analysis. It can be used to analyze stock data and events. To do this, the data needs to be imported into a Pandas DataFrame. Once the data is in the DataFrame, it can be manipulated and analyzed. Pandas can be used to calculate the mean, median, and standard deviation of the data. It can also be used to create charts to visualize the data. Pandas also allows for filtering and sorting of the data. This can be used to analyze events and trends in the data.

Pandas is a helpful tool for analyzing stock data and events. It can be used to import, manipulate, and analyze the data. Calculations such as the mean, median, and standard deviation can be done with Pandas. Additionally, charts can be created to visualize the data. The data can also be filtered and sorted to analyze events and trends.

Pandas is a powerful tool for analyzing stock data and events. It can be used to import, manipulate, and analyze the data. Calculations such as the mean, median, and standard deviation can be done with Pandas. Additionally, charts can be created to visualize the data. The data can also be filtered and sorted to analyze events and trends. This makes it easy to identify patterns and trends in the data.

Pandas is a useful library for analyzing stock data and events. It provides powerful tools for importing, manipulating, and analyzing the data. It can be used to calculate the mean, median, and standard deviation. Additionally, charts can be created to visualize the data. The data can also be filtered and sorted to identify trends and events. This makes it easy to analyze stock data and events.

Check out the full post at wrighters.io.