Algorithmic Trading Using Logistic Regression

In order to implement an algorithmic trading strategy though, you have to first narrow down a list of stocks that you want to analyze. This walk-through provides an automated prologisticcess (using python and logistic regression) for determining the best stocks to algo-trade.

I will dive deeper into the logic and code below, but here is a high-level overview of the process:

- Import the historical data of every stock using yahoo finance.

- Pull in over 32 technical indicators for each stock using the technical analysis library.

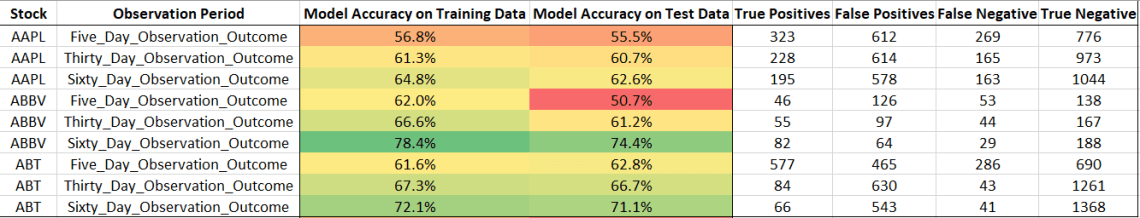

- Perform a logistic regression on each stock using 5, 30, and 60 day observation time periods.

- Interpret the results.

View this article on https://handsoffinvesting.com.